👉Dogex

Dogex添加池子教程

注意:加池子会有超卖的风险,请考虑清楚再添加!(例如你注入 1000dogim,而池内只>=1000dogim,那么无法撤出流动性)

中文版:

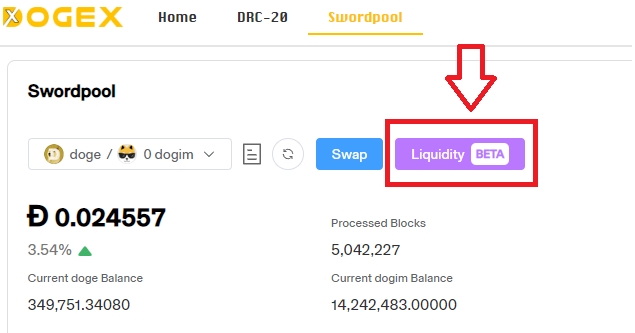

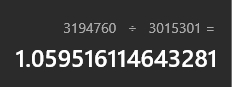

1.Dogex添加流動性的方法

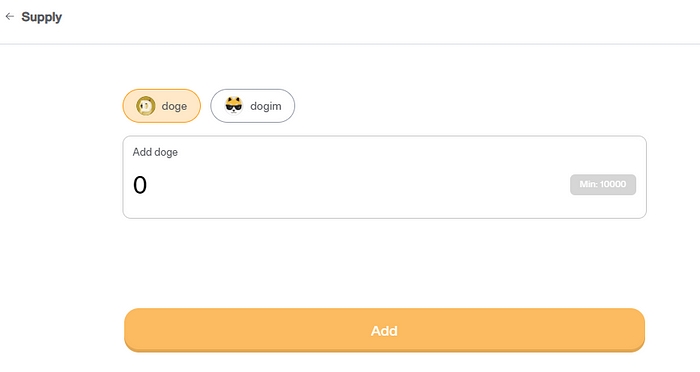

第一步

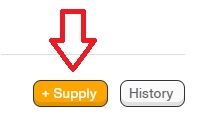

第二步

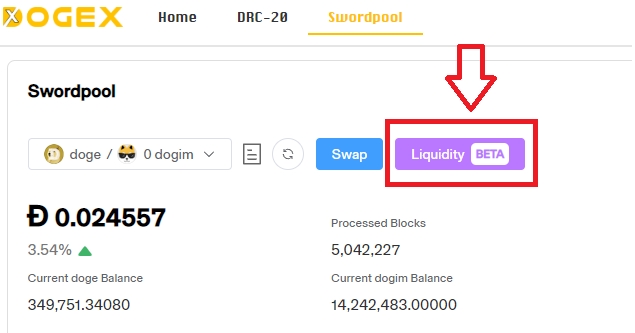

第三步

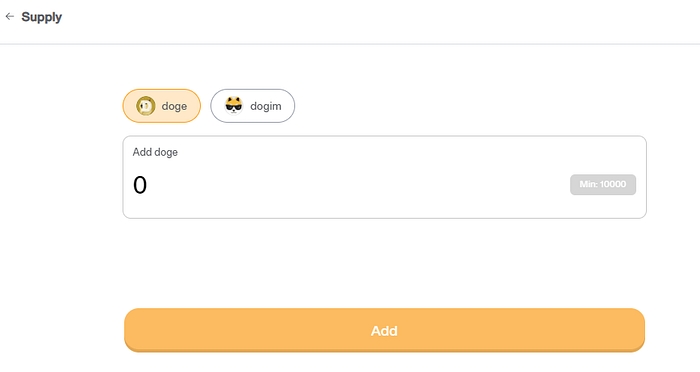

選擇要置押的doge顆數

第四步

會出現下列方塊

可以想像成掛單,到自己想入手的價位,能選擇撤出換取Dogim

Expect out顯示的就是你當前價位能獲得的dogim顆數

2. Dogex添加流動性的優點

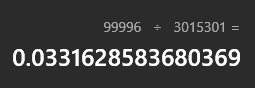

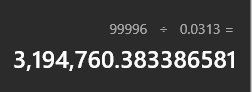

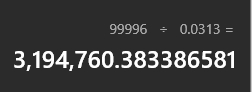

以這筆交易來說

如果使用swap交易

花費99996顆Doge獲得3015301顆dogim 於價格D0.0313時購買

會造成Dogim價格上升至D0.0331

這中間造成滑點使得購買成本升高

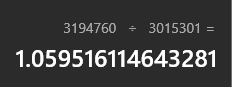

如果使用添加流動性(動態掛單方式)於D0.0313時撤出流動性

會獲得3194760顆dogim

比直接swap多獲得179459顆dogim

等於多獲得5.95%的dogim顆數

3. 適合添加流動性的人群

單筆購買數額大的大戶

想在理想價位無滑點買入或售出的群體

沒有急迫需要買入或售出的群體

4. 注意事項

置押流動性需鎖倉360個區塊(約六小時)無法馬上撤銷

質押多筆的情況下只能從第一筆開始撤銷流動性

流动性管理规则

我们测试了两种模型,最终抛弃了添加流动性产生利息的模型。取而代之的是另外一种买/卖模型

例如 我看好某个代币 A 不看好我手中的 B ,为此我将代币 B 注入池子,这样当 A 的价格升高后,我将可以换得更多的 A,因为我让更多人去买B,并且此时池子不在收取 1% 手续费用。

此时系统设定了 360 个区块后执行移除操作。

计算公式为 x * (current_balance_a / current_balance_b) , 相比于其他模型会产生无偿损失,同样的这类模型也有超卖的风险,但会促进交易发生的频率

当你决定回收利益的时候,会按照当前余额及以上公式计算所得,但是会出现超卖的风险,例如池中的代币 a 余额不足以提供你所能获得的收益时,此时你将无法撤出

请记住你提供的流动性有360个区块时限并且只会收到对手代币,例如 你添加流动性 b 是为了获得 a

请注意当你进行交易时证明你同意了我们的规则,出现任何短期内的剧烈波动,请自担风险

系统仍然在调整中,例如如果这个模型不够合理,我们会考虑调整规则及算法。

添加流动性时为了识别交易我们会收取 10 个doge,移除时会收取1.42个doge

只能先移除最先加入的流动性

English version:

Methods for Adding Liquidity to Dogex

Step 1

Step 2

Step 3

Select the number of Doge to add

第四步

The following box will appear.

Think of it as placing an order at the desired price; you can choose to withdraw and exchange for Dogim.

The “Expect out” displays the number of Dogim you can currently obtain at your current price.

2. Advantages of Adding Liquidity to Dogex

In this transaction:

If using a swap trade, spending 99,996 Doge to obtain 3,015,301 Dogim at a price of D0.0313 would cause the Dogim price to rise to D0.0331.

This results in slippage, increasing the purchase cost.

If using liquidity addition (dynamic order placement) and withdrawing liquidity at D0.0313, you would get 3,194,760 Dogim.

This is 179,459 more Dogim than a direct swap, equivalent to an additional 5.95% in Dogim quantity.

3. Target Audience for Adding Liquidity

Large holders making substantial single purchases

Those wanting to buy or sell at ideal prices without slippage

Individuals without an urgent need to buy or sell

4. Important Notes

Staking liquidity requires a lock-up period of 360 blocks (approximately six hours) and cannot be immediately withdrawn.

When staking multiple transactions, liquidity can only be withdrawn starting from the first transaction.

Liquidity Management Rules

We tested two models and ultimately abandoned the model that generated interest from liquidity. Instead, we adopted another buy/sell model.

For instance, if I have confidence in a certain token A and am less optimistic about token B in my possession, I will inject token B into the pool. This way, when the price of A increases, I will be able to acquire more A because I attract more people to buy B, and the pool does not charge a 1% fee at that time.

The system sets a removal operation to be executed after 360 blocks.

The calculation formula is x * (current_balance_a / current_balance_b). Compared to other models, this may not result in uncompensated losses. But, this type of model carries the risk of overselling but promotes the frequency of trading.

When you decide to withdraw your earnings, it will be calculated based on the current balance and the formula mentioned above. However, there is a risk of overselling, for example, when the balance of token A in the pool is insufficient to provide the profits you could gain, at which point you will be unable to withdraw.

Please remember that the liquidity you provide has a 360-block time limit, and you will only receive the opposing token. For example, if you add liquidity with token B to acquire token A.

Please be aware that when you engage in trading, you are confirming your acceptance of our rules. In the event of any significant short-term fluctuations, you assume the risk.

The system is still under adjustment. For example, if this model is not deemed reasonable, we will consider adjusting the rules and algorithms.

When adding liquidity, in order to identify transactions, we will charge a fee of 10 Doge to add and 1.42 Doge for remove

and min token doge liq it's 10000 doge and min other liq it's 100000

The first liquidity added must be removed first.

Last updated